DynamicSpirit

Established Member

And a great big giveaway via the lowest rates of corporation tax in the developed world, which, combined with the lack of control on money moving in and out of the country, has encouraged brass-plating rather than useful, productive economic activity

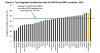

Corporation tax by itself is not a good indication of effective business tax rates, because it only gives half the story: Usually, business owners pay two sets of tax: Corporation tax when profits are made, and then dividend tax when those profits are distributed to shareholders. You need to add both taxes together to see the tax that is - in most cases - actually paid. Unfortunately, there doesn't seem to be a lot of data around that does that, but I managed to find this graph, which shows the UK was actually fairly average for the developed world in 2014. (In this graph, "Integrated dividend tax" = corporation tax + dividend tax. No idea how reliable the source is, but the graph is taken from a document whose purpose seems to be to argue that US corporate tax rates are too high, so isn't particularly focused on the UK and therefore probably has no reason to mislead about the UK).

Since 2014, the UK Government has reduced corporation tax and increased dividend tax to balance, so the picture probably hasn't changed much. (Most commentators in the UK who complain about corporation tax going down conveniently forget about the dividend tax going up).

(Even with 'integrated dividend tax' it's hard to do a good comparison, because you have to factor in different treatment of allowances for expenses, as well as things like tax-free allowances in different countries, which is horrendously complex)

Last edited: