overthewater

Established Member

- Joined

- 16 Apr 2012

- Messages

- 8,170

Are you just reading on paper that it is profitable or do you know Glasgow well enough to say it's profitable?

At a guess I'd say that overthewater is based in Scotland, so I'd probably say he/she has more knowledge of whether it's profitable. It's similar to your views and comments on Somerset.

More than me that see it first hand:

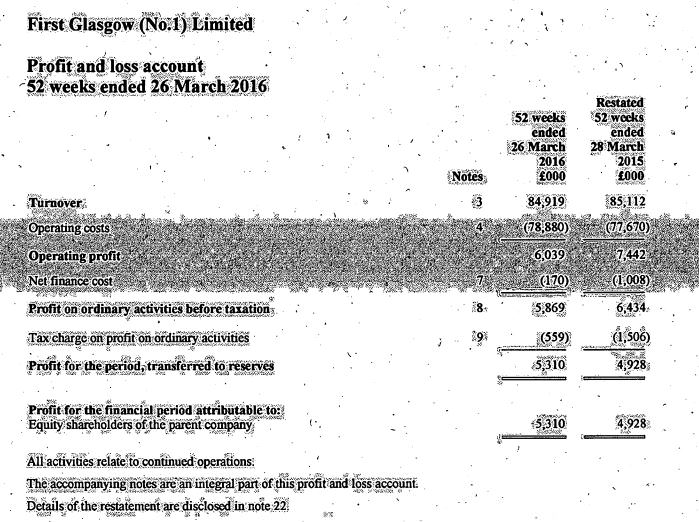

I will happily repost the account for FIG No1, Look at the accounts, look at the fleet, ( really look at it) then look at the investment since 2012: It's not that great. the numbers really dont stack up.... Its has all the hallmarks of Wigan... much much older fleet and half decent profit.

Fig No2 has much better fleet investment, lots of new buses, and overall its profits are larger % compared to the Turnover. Where the big money then? If Glasgow City is that great? There still have plenty of older 10 -13 years + on core routes.

Its clever trick.... Why isnt FIG no1 and no2 not on the same accounts? its to help No2 stay better. its the same reason why FSE was separated from Midland bluebird accounts, to make MB healthier.

Last edited: