miklcct

On Moderation

Recently, after Chase changed the cashback terms and conditions, I have difficulty obtaining cashback for my train ticket purchases. It has specifically listed train ticket purchases are eligible, but I have bought train tickets from two different third party retailers and they didn't earn me any cashback, because the MCC (merchant category code) was wrong.

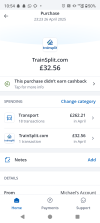

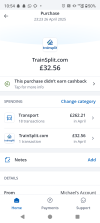

One was from Uber Travel and it used 4211 (taxis and limousines), another was from Trainsplit, and it used 4722 (travel agencies), after querying the customer support of the bank. These two codes are not codes for railways / passenger trains so they didn't result in cashback from my bank. I tried to contact Uber support and the support team was useless and couldn't even understand what I was talking about.

I bought some high value tickets from these retailers and would like to rectify the issue. As a consumer who should I escalate to in order to get the cashback by buying train tickets? It seems that Uber and Trainsplit lied to the card network the nature of the transactions, but legally do I have any recourse?

The following are my transaction records. As seen, I couldn't obtain 1% cashback from bank which was a significant amount in the second case.

One was from Uber Travel and it used 4211 (taxis and limousines), another was from Trainsplit, and it used 4722 (travel agencies), after querying the customer support of the bank. These two codes are not codes for railways / passenger trains so they didn't result in cashback from my bank. I tried to contact Uber support and the support team was useless and couldn't even understand what I was talking about.

I bought some high value tickets from these retailers and would like to rectify the issue. As a consumer who should I escalate to in order to get the cashback by buying train tickets? It seems that Uber and Trainsplit lied to the card network the nature of the transactions, but legally do I have any recourse?

The following are my transaction records. As seen, I couldn't obtain 1% cashback from bank which was a significant amount in the second case.