Latest data for last Quarter has been released.

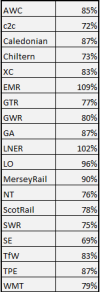

All TOCs saw growth in passenger figures, with the Elizabeth Line (unsurprisingly) seeing the most growth at 40%, followed by Avanti at 38%, Scotrail at 34%, TPE at 33%, Lumo at 29%, Hull Trains at 27%, XC at 26%, EMR at 23%, GC at 22%, Cal Sleeper at 20%, LO at 20%, WMT (WMR and LNR) at 20%, TFW with 19%, Greater Anglia at 18%, Chiltern at 16%, SWR at 15%, Merseyrail at 15%, Northern at 14%, SE at 14%, GTR at 13%, GWR at 10%, LNER at 6%, C2C at 6% and Heathrow Express at 5%.

I'm particularly surprised that Avanti grew so much as they are a Long Distance operator, this indicates more growth in long distance leisure and business travel. HX growing also surprises me with EL coming online, but Heathrow as an airport saw an increase in passenger numbers so this means that more people are using both HX and EL.