Recently, Scotrail has started to have 4.25% cashback from a cashback site, which I suggested to some friends use.

However, one of my friends used Chase Debit Card which is an online-based, and the physical debit card does not carry a card number or expiry information (just as a physical medium of the virtual card).

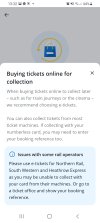

She couldn't collect the ticket from the ticket machine as it seems the card details do not match, while the ticket office (small local station in SW London) is unable/unwilling to help with releasing the ticket, claiming she needs to call Scotrail to rectify the issue. Is there any advice I can do to her, to avoid such chaos in future (other than getting another bank's card, as she is not getting an address proof to open a physical bank account in the UK yet)?

(Many of the journeys will be cross London journeys, so a e-ticket is also not an option)

However, one of my friends used Chase Debit Card which is an online-based, and the physical debit card does not carry a card number or expiry information (just as a physical medium of the virtual card).

She couldn't collect the ticket from the ticket machine as it seems the card details do not match, while the ticket office (small local station in SW London) is unable/unwilling to help with releasing the ticket, claiming she needs to call Scotrail to rectify the issue. Is there any advice I can do to her, to avoid such chaos in future (other than getting another bank's card, as she is not getting an address proof to open a physical bank account in the UK yet)?

(Many of the journeys will be cross London journeys, so a e-ticket is also not an option)