Death

Established Member

Hail all!

The following has been edited and copied over from the London Christmas bash - 23rd Dec 2008CE thread to try and prevent a mass of off-topic and irrelevant discussion occurring in said thread. 8) hock::roll:

hock::roll:

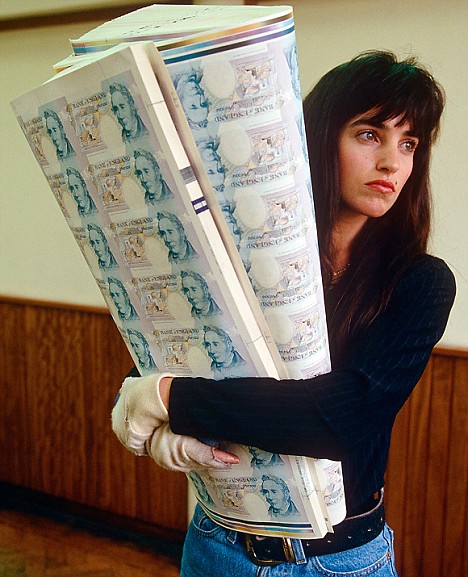

I wandered into my building society the other day to carry out some account maintenance, and check the status of my savings that are held in a cash-based ISA. Thanks to all of these World credit screw-ups - And the associated interest rate adjustments that have been made in a vain attempt to stem them - The interest rate that I was getting (Which was about 4.75% back in April) has now plumetted to a measly 1.07%! hock::roll::mad:

hock::roll::mad:

Ye know...I've got a damn strong temptation to take the Bank of England to court over these interest rate reductions. Although they'll make life easier for borrowers at the current time, it's savers like myself (My borrowing currently totals £0.00) who keep much needed money inside the banking system - And what do we get in return for helping to keep the economy afloat?

After all, the World economy has collapsed through the fault of (As I see it) several foolish American mortgage institutions handing out money to people without checking for adequete solvency beforehand, and personally I don't see why the Hell savers and investors like myself should have to suffer because of it. If anyone should have to suffer as a result of all of this; It should the creditors, financiers, accountants and MDs of the companies that started all of this off in the first place!

So: How has everyone else been affected by this "Credit Crunch" runaround...And why on Earth havn't World banks and governments taken a hard line (Such as changing laws, forcing debt write-offs etc.) on sorting things out like they should've done long before the whole thing began to spiral out of control? :roll:

:roll:

Farewell...

>> Death <<

The following has been edited and copied over from the London Christmas bash - 23rd Dec 2008CE thread to try and prevent a mass of off-topic and irrelevant discussion occurring in said thread. 8)

Yeah, right...With todays Credit Crunch, and many American businesses deciding to totally screw up the Worlds cash economy through excessive and unmoderated lending, half-decent interest is now truly a thing of the past!yeah [A Solo card would be better because of the] interest

I wandered into my building society the other day to carry out some account maintenance, and check the status of my savings that are held in a cash-based ISA. Thanks to all of these World credit screw-ups - And the associated interest rate adjustments that have been made in a vain attempt to stem them - The interest rate that I was getting (Which was about 4.75% back in April) has now plumetted to a measly 1.07%!

Ye know...I've got a damn strong temptation to take the Bank of England to court over these interest rate reductions. Although they'll make life easier for borrowers at the current time, it's savers like myself (My borrowing currently totals £0.00) who keep much needed money inside the banking system - And what do we get in return for helping to keep the economy afloat?

After all, the World economy has collapsed through the fault of (As I see it) several foolish American mortgage institutions handing out money to people without checking for adequete solvency beforehand, and personally I don't see why the Hell savers and investors like myself should have to suffer because of it. If anyone should have to suffer as a result of all of this; It should the creditors, financiers, accountants and MDs of the companies that started all of this off in the first place!

So: How has everyone else been affected by this "Credit Crunch" runaround...And why on Earth havn't World banks and governments taken a hard line (Such as changing laws, forcing debt write-offs etc.) on sorting things out like they should've done long before the whole thing began to spiral out of control?

Farewell...

>> Death <<